For many years, I have worked with programs that help low-income people get their taxes done professionally. Through this experience I realized that low-income individuals have government subsidies to help them prepare quality tax returns, while people with very high incomes have the resources to hire an Enrolled Agent, Lawyer or Accountant, but what about the middle class?

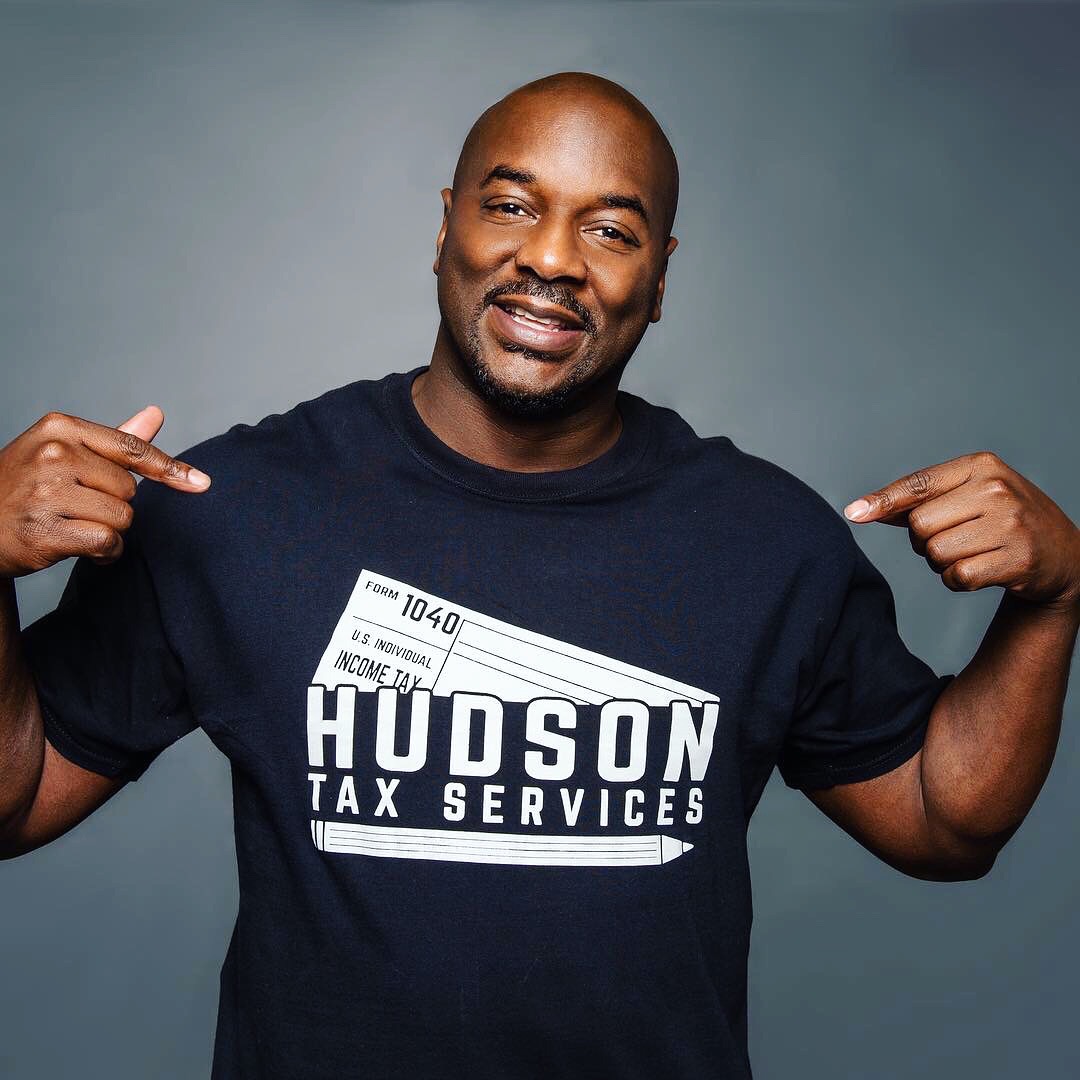

It was with that revelation that Hudson Tax Services was founded in 2008. It was built on the premise that Convenient, Affordable and Quality tax prep services should also be available for the “everyday taxpayer”. I will work with you on a personal level to determine the best solutions for your unique needs, then leverage my seasoned expertise to achieve the best possible results.

Convenient

Let’s just face it, we are all busy and most people do not have the time to visit a tax office to get their taxes prepared. With Hudson Tax Services you can have your taxes prepared “virtually” without ever leaving your home, no matter where you live. If you can fax, scan or simply use the camera on your smart phone, you can get your taxes done.

Affordable

I often say that high income earners can afford an accountant and low-income individuals can get their taxes done for free, for everyone else there’s Hudson Tax Services.

My ultimate goal is to prepare accurate federal and state tax returns, as well as becoming my clients’ most trusted resource for all tax related questions or concerns.

Quality

Most importantly, I am an Enrolled Agent (or EA), a federally authorized tax practitioner empowered by the U.S. Department of the Treasury to represent taxpayers before the Internal Revenue Service (IRS). I earned this privilege by passing a three-part comprehensive IRS test covering individual and business tax returns. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years. Enrolled Agents pride themselves on preparing accurate tax returns and shy away from any unscrupulous activities. Enrolled Agents also have unlimited practice rights and are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they can represent clients before. This power allows Enrolled Agents to help any taxpayer or business with lien/levy removals, offer in compromises, installment payment negotiations and fee abatement’s to name a few.

Enrolled agents are “America’s Tax Experts!”